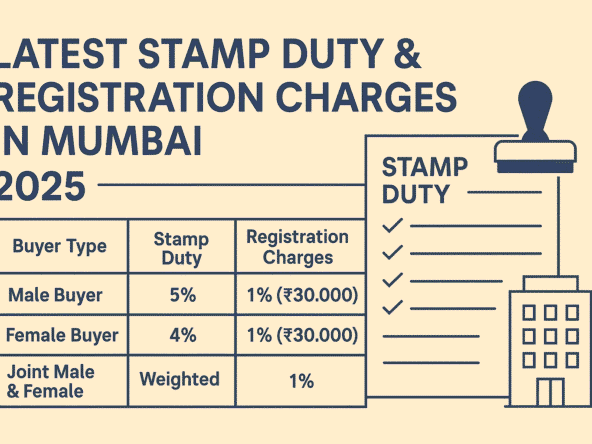

The Stamp Duty Rates in Maharashtra have been affected by the latest Ready Reckoner (RR) rate hike, announced by the Maharashtra government for the financial year 2025-26, effective April 1, 2025. The average RR rate increase of 3.89% will impact property valuations, stamp duty costs, and real estate transactions across Mumbai, Thane, Pune, and Solapur. Homebuyers and investors must stay informed to make the right property decisions.

City-Wise Stamp Duty & Property Valuation Updates

Mumbai Property Valuation 2025

Mumbai’s RR rates have increased by 3.39%, impacting stamp duty charges and overall property prices.

Thane & Solapur Property Prices 2025

- Thane RR rates surged by 7.72%, making real estate investments costlier.

- Solapur witnessed the highest hike of 10.17%, significantly affecting property affordability.

New Stamp Duty Rates in Maharashtra & RR Rates Increase Impact on Homebuyers

With the RR rate hike, stamp duty calculations will increase transaction costs, making home loans and down payments more expensive.

How the Stamp Duty Rate Changes Affect the Maharashtra Real Estate Market

✅ Government-Approved Property Rates in Mumbai – The new RR rates serve as a benchmark for property valuation, impacting capital gains tax, stamp duty, and registration fees.

✅ Real Estate Investment in Mumbai 2025 – Despite the rise in stamp duty rates in Maharashtra, Mumbai remains a prime investment destination due to strong rental demand, infrastructure growth, and capital appreciation.

✅ Maharashtra RR Rate Hike Latest News – Experts predict a temporary slowdown in transactions, but long-term growth prospects remain strong.

Conclusion: What Should Homebuyers & Investors Do?

With the increase in Stamp Duty Rates in Maharashtra and RR rate revisions, it’s essential to plan property investments wisely. Buyers should factor in rising costs, while investors can leverage this information to negotiate deals before further hikes.

📢 Want to stay updated on Maharashtra’s real estate trends? Follow us for the latest updates!